Investing in Zimbabwe

It is almost 20 years since I first visited Zimbabwe. I recall there was a lot of angst among businesspeople about the antics of President Mugabe at that time. Even then, his tenure was seen as unsustainable. Yet, he persisted to become one of the longest serving and oldest heads of state in the world.

In the years since, I’ve spent many years involved in southern African mining and exploration as a corporate executive, either visiting the region or being located there as an expatriate. Time and again, I have seen that the local view on Mugabe, and politics in general, is quite different from the picture painted by major international news outlets.

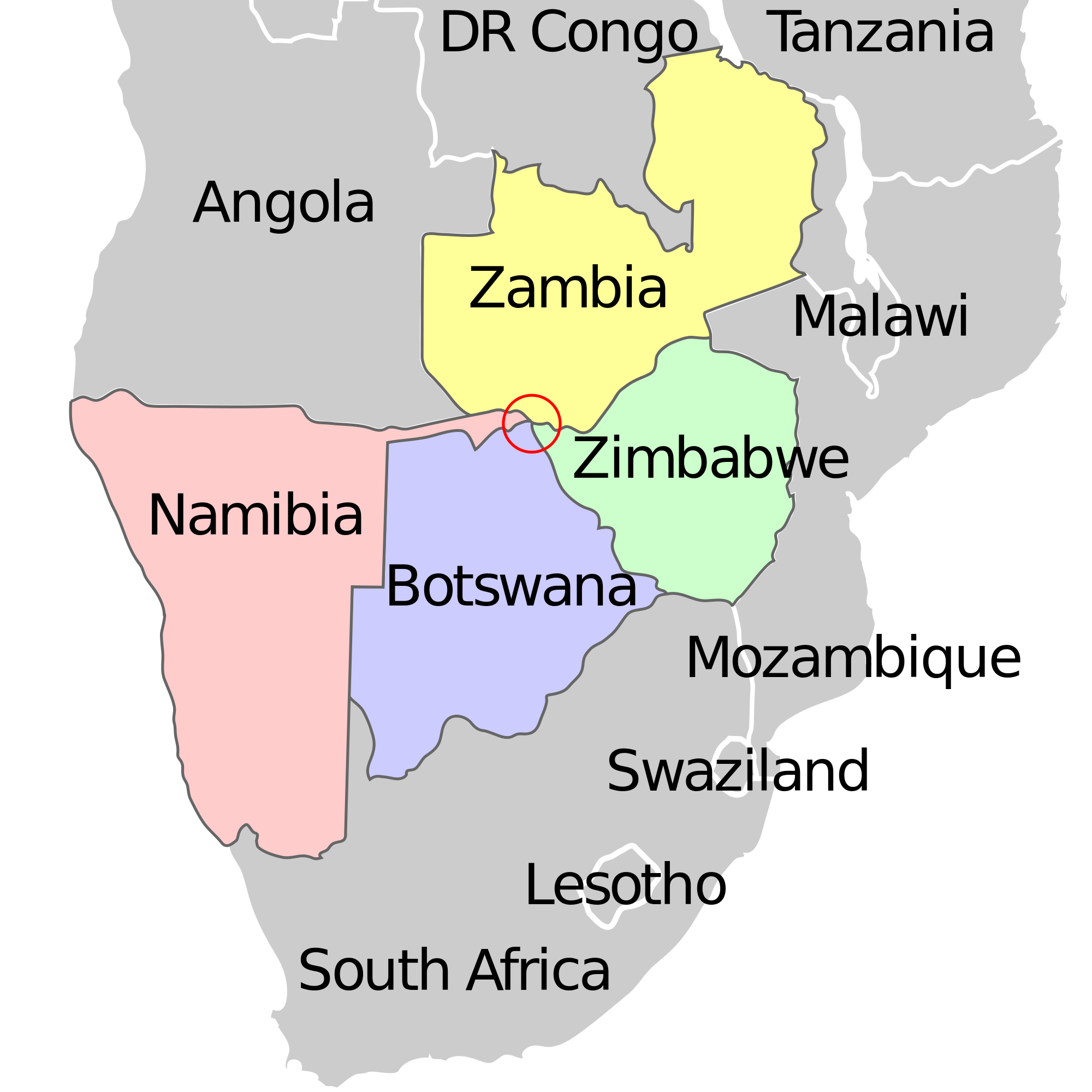

The news that President Mugabe has been deposed is a pivotal moment for those with an interest in investing in southern Africa. Of course, times of turbulence produce opportunities, but there is also a need for clear-eyed realism. It is my view that the west has poorly understood the internal politics of Zimbabwe. So, for those interested in investing there, it is vital to understand well what is going on.

Robert Mugabe is generally seen as a cardboard cutout caricature of the despotic African ruler. Violent, venal and volatile, he is portrayed without any redeeming features. Yet, clearly western observers have not understood the nature of support for Mugabe and this prevented a good understanding of why he was able to survive for so long.

Around the time of my first visit to Zimbabwe, I attended a cocktail party in London where there were a number of business people from Zimbabwe attending. There I met a young Zimbabwean expatriate. I watched in interest as people discussed Zimbabwean politics with him. There was an automatic assumption he would be anti-Mugabe. He politely agreed with his inquisitors, out of either deference or timidity. However, I sensed a lack of conviction in his answers. Afterwards I approached him and quizzed him about what he really thought of Mugabe. His views were complex and nuanced. He was well aware of atrocities and corruption. But he felt a deep respect and gratitude for the man who had liberated his beloved homeland from white minority rule.

It is clear Zimbabwe is in a terrible state after 37 years of Mugabe’s leadership. There is well-founded disgust at the trashing of an economy, the human rights record of the country, the manipulation of election results and the victimisation of political opponents.

Yet, we should be uncomfortable with the simplicity of that narrative. It is rare for autocrats to hold onto power as long as Mugabe without a base of popular support. In Zimbabwe, there is a functioning – albeit imperfect – parliamentary system in place. There are regular elections, despite evidence of vote tampering. And there is a degree of freedom of movement and freedom of the press, despite clear examples of repression.

More importantly, the simple narrative that Emmerson Mnangagwe is the herald of a new age of liberal democracy, prosperity and the end of corruption should also be treated with skepticism. He is a ZANU insider who has been close to Mugabe for 50 years. He has presided over awful atrocities. He is wealthy beyond the normal expectations of elected officials.

In an uncertain and volatile period like this, investment risks in locations like Zimbabwe requires a disciplined approach to risk management. We don’t yet know how the new presidency will develop. For those with an eye to pursue the opportunities that this country offers, it is important to be closely observing the country.

Having a presence on the ground is important, ensuring there is good access to primary information from government officials, diplomats, journalists and other business people. Intelligence will be messy and at time unreliable, but there is no substitute for being close to the source.

It is important to look closely at the optionality of investment proposals. Capital investments should be configured to reduce the investment at risk at any one time. There must be a clear plan for how to withdraw if the political situation turns bad. Potential local partners with good local knowledge and a compatible approach to business ethics should be examined.

Having sound governance processes for operating in the country is critical. In particular, clear plans for dealing with the expectation of corrupt payments are essential. Increasingly investors are not prepared to accept a blind eye to such practices, and extra-territorial anti-corruption legislation in Australia, North America and the UK place executives at personal risk of prosecution.

It is vital to consider the safety of staff, both local and expatriate. Planning for the possibility of an increase in unrest is important, even at the calmest of times. Being aware of regional disturbances is important if your people are travelling away from major metropolitan centres. Evacuation, security and medical support plans need to be in place and up to date.

Investing in developing countries is not for the faint of heart, but it offers great potential rewards. With recent changes in Zimbabwe, we may be seeing new opportunities opening up, but investors need to approach with a strong focus on risk identification and mitigation.

David Paterson is Director of Emergent Advisory, a Melbourne based consulting firm that provides strategic communications and reputation management services to the resources sector. He has worked in the mining industry for 30 years, including 25 years with Rio Tinto, where he held senior roles in Australia, Asia, Africa and Europe. An economist by training, David is of the view that strategic communications is a powerful source of value creation and protection for firms operating in emerging markets.